Die Pandemie hat den europäischen Gebrauchtwagenmärkten solide Gewinne beschert, mit Preisen, die durch die Decke gingen. Doch in diesem Jahr hat sich die Situation geändert, und der Gebrauchtwagenmarkt ist unter Druck geraten. Dr. Christof Engelskirchen, Chief Economist der Autovista Group, gibt eine Prognose für das Jahr 2023 ab.

Während der Pandemie boomten die Gebrauchtwagenmärkte. Die Nachfrage überstieg das Angebot, da die Menschen nach sicheren Alternativen zu öffentlichen Verkehrsmitteln suchten und ältere Gebrauchtwagen durch neuere ersetzten. Die Preise stiegen immer weiter.

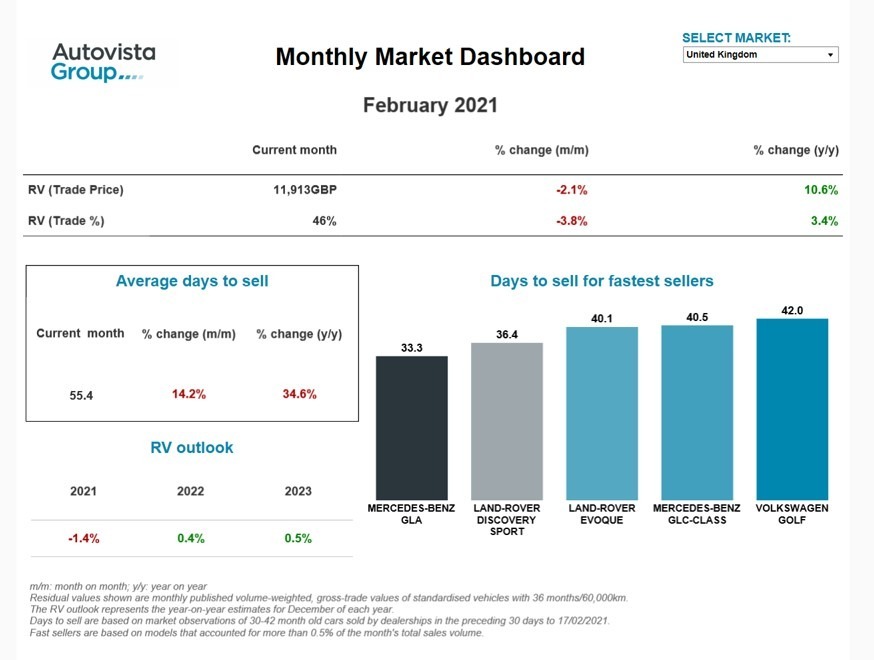

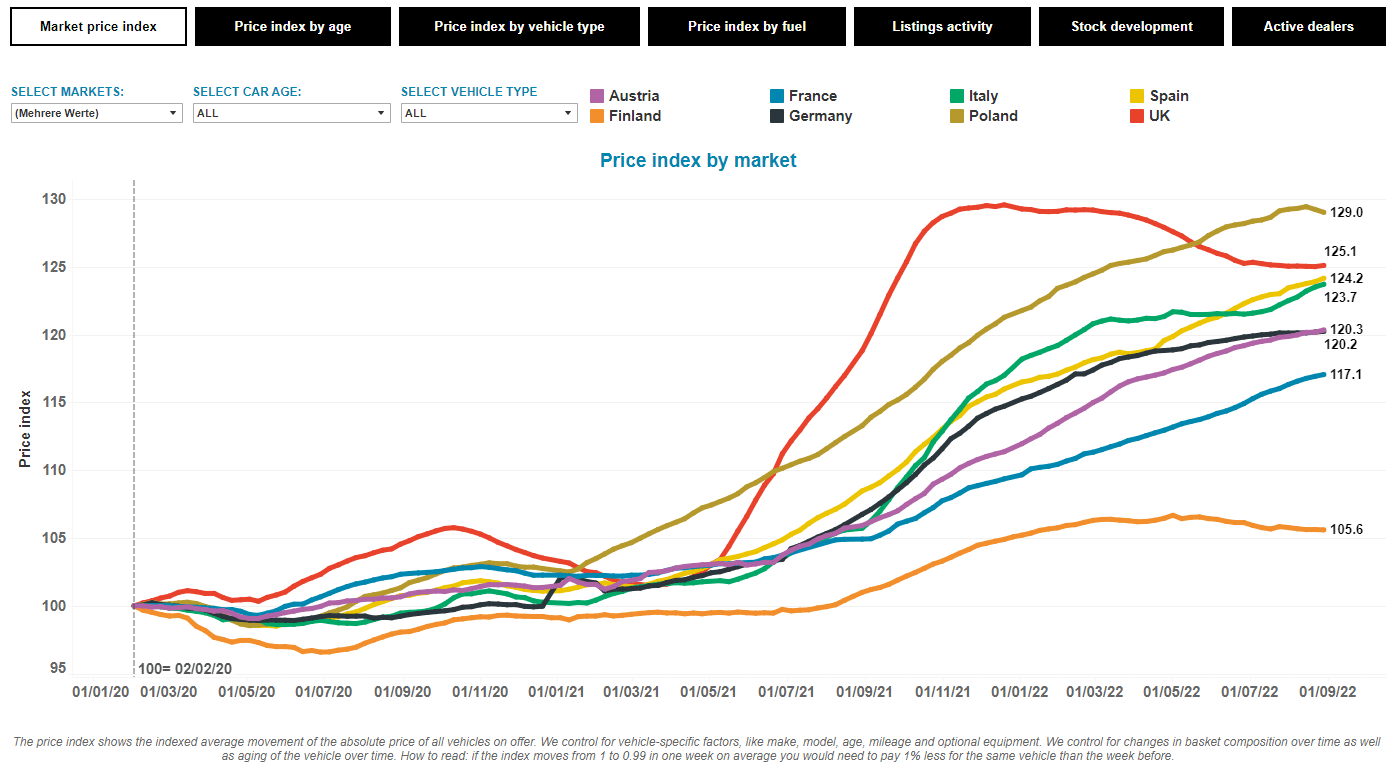

Auch das reduzierte Neuwagenangebot trug zu einem Aufschwung der Gebrauchtwagenmärkte bei. Dies bescherte den Stakeholdern, die gleichzeitig ein mangelndes Angebot beklagten, satte Gewinne. Der Preisanstieg hat sich in letzter Zeit verlangsamt, aber der Markt hat seinen Wendepunkt noch nicht erreicht – mit Ausnahme einiger kleinerer Abwärtskorrekturen, wie zum Beispiel in Finnland, Polen und Großbritannien.

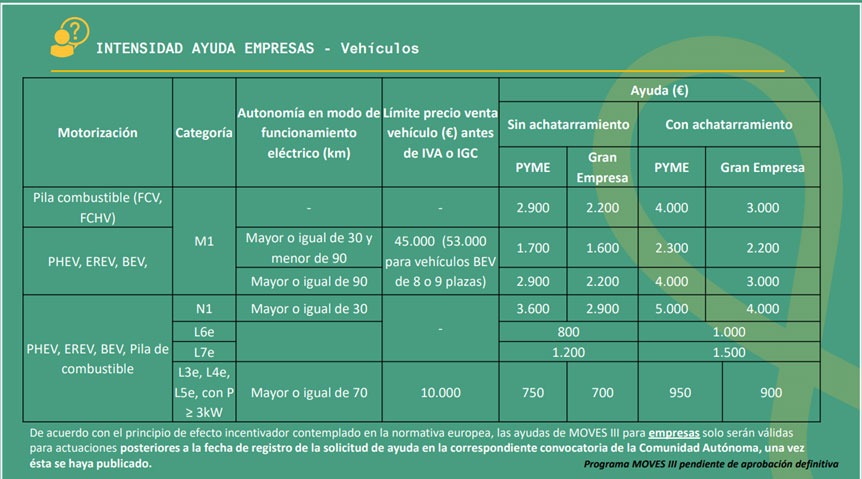

Gebrauchtwagen-Preisindex nach Land

Quelle: Autovista Group, Residual Value Intelligence

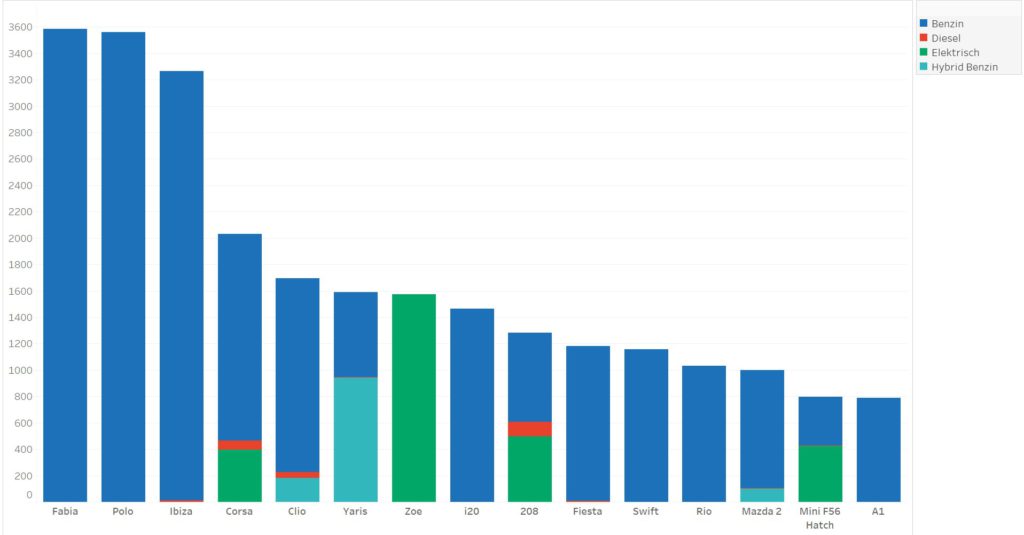

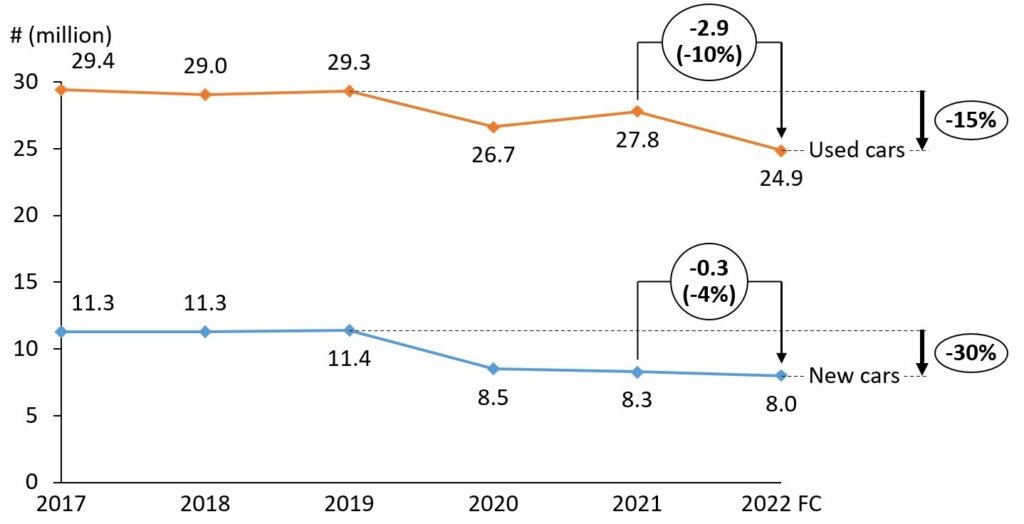

Weniger Gebrauchtwagen-Transaktionen im Jahr 2022

Im Vergleich zu den Neuzulassungen hielten sich die Gebrauchtwagenverkäufe zunächst gut. Zwischen 2019 und 2020 gingen die Gebrauchtwagenverkäufe in den fünf großen europäischen Märkten (Deutschland, Frankreich, Italien, Spanien und Vereinigtes Königreich) zwar um 2,6 Millionen Einheiten zurück (von 29,3 Millionen auf 26,7 Millionen), was teilweise auf Lockdowns zurückzuführen war. Jedoch erholten sich die Gebrauchtwagenmärkte rasch wieder und erreichten bald 27,8 Millionen Transaktionen, was einem Rückgang von lediglich 5 % gegenüber dem Jahr 2019 – dem Jahr vor der C0VID-19-Pandemie – entspricht.

Im Vergleich dazu gingen die Neuwagenverkäufe im Jahr 2020 gegenüber 2019 um etwa 25 % zurück und lagen am Ende leicht unter dem Niveau von 2021. Laut den jüngsten Prognosen für 2022 könnten die Neuwagenverkäufe weiter zurückgehen, allerdings nicht in demselben Ausmaß wie die Gebrauchtwagenmärkte, die 2022 gegenüber 2021 rund drei Millionen Transaktionen verlieren werden.

„Im dritten Jahr der unterbrochenen Lieferketten für die Automobilindustrie wendet sich das Blatt für die Gebrauchtwagenmärkte“, meint Andreas Geilenbrügge, Head of Valuations & Insights bei Schwacke (Teil der Autovista Group), dazu. „Das Gebrauchtwagengeschäft gerät unter Druck. Unsere jüngste Prognose zeigt, dass es allein für Deutschland im Jahr 2022 eine Million weniger Gebrauchtwagen-Transaktionen geben wird. Die Zahl der erwarteten Transaktionen liegt nur etwa bei 5,7 Millionen, verglichen mit 6,7 Millionen im Jahr 2021 – ein Rückgang von 15 %.”

Neu- und Gebrauchtwagen-Transaktionen in den fünf größten Märkten 2017-2022*

Konsumklima auf historischem Tiefstand

Dieser Rückgang ist deutlicher, als viele Marktteilnehmer zu Beginn des Jahres erwartet hatten. Es gibt mehrere Gründe, warum die Gebrauchtwagenmärkte derzeit so angespannt sind:

● Angesichts der galoppierenden Inflation sind die Gebrauchtwagenpreise so stark gestiegen, dass die Elastizität der Nachfrage zum Tragen kommt. Die Menschen überlegen sich genau, ob sie sich den Kauf eines Gebrauchtwagens zu diesem Preis leisten können. Die Alternative ist, länger an einem bestehenden Gebrauchtwagen festzuhalten.

● Eine veränderte Geldpolitik der Zentralbanken, die auf die Bekämpfung der Inflation abzielt, birgt die konkrete Gefahr negativer Folgen für die Wirtschaft und die Arbeitsmärkte. Dies ist ein weiterer entscheidender Faktor für zögerliche Kaufentscheidungen.

● Die russische Aggression in der Ukraine fügt der Gleichung eine weitere Ebene der Unsicherheit hinzu, die nicht nur mit den steigenden Energiekosten zusammenhängt. Das Vertrauen der Verbraucher befindet sich auf einem historischen Tiefstand.

● Der anhaltende Mangel an Neuwagenangeboten verringert auch die Zahl an verfügbaren Gebrauchtwagen. So müssen beispielsweise Modelle, die 2018/2019 neu zugelassen wurden und bei denen nun eine Verlängerung des Leasingvertrags ansteht, länger gehalten werden, da keine Ersatzwagen hereinkommen – wodurch sich die Gesamtzahl der neu gelisteten Gebrauchtwagen verringert. Darüber hinaus bedeuten die vergangenen drei Jahre mit deutlich weniger Kurzzeit-Zulassungen eine geringere Anzahl an (jungen) Gebrauchtwagen auf dem Markt.

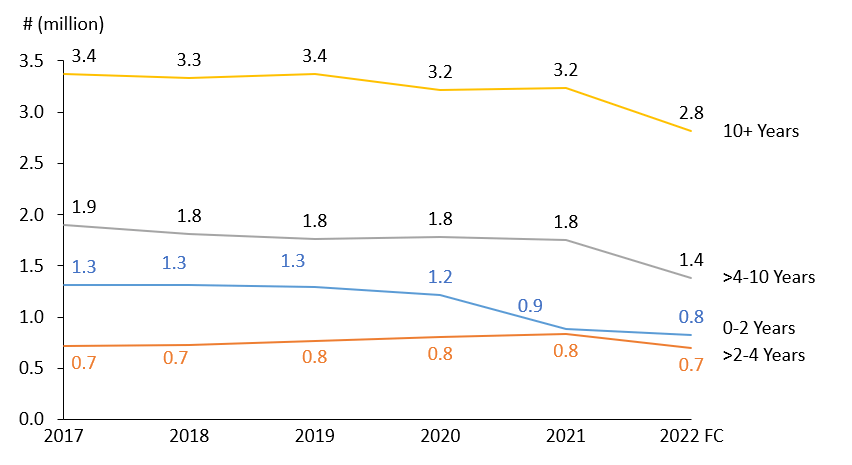

Weniger Gebrauchtwagen-Transaktionen

Die rückläufige Entwicklung auf den Gebrauchtwagenmärkten ist weitgehend auf ältere Gebrauchtwagen zurückzuführen, d. h. auf solche, die älter als vier oder sogar zehn Jahre sind. Die Geschäfte mit jüngeren Gebrauchtwagen, insbesondere mit solchen, die aus dem Leasing kommen, haben sich bemerkenswert gut gehalten. „Sie liegen weitgehend auf Vorkrisenniveau“, so Marc Odinius, Managing Director bei Dataforce. „Wir beobachten nun auch, dass der erwartete Rückgang bei den Kurzeit-Zulassungen auf die Gebrauchtwagenmärkte durchschlägt, da die OEMs nach höherwertigen Kanälen suchen. Aus diesem Grund sind die Gebrauchtwagen-Transaktionen in der Altersgruppe zwischen null und zwei Jahren rückläufig. Der stärkste Rückgang ist jedoch eindeutig bei den älteren Fahrzeugsegmenten zu verzeichnen.”

Gebrauchtwagen-Transaktionen nach Alter (Beispiel: Deutschland) Januar 2017-2022*

*Ganzjahresprognose für 2022

Quelle: Nationale Zulassungsstellen, Dataforce, Autovista24 analysis

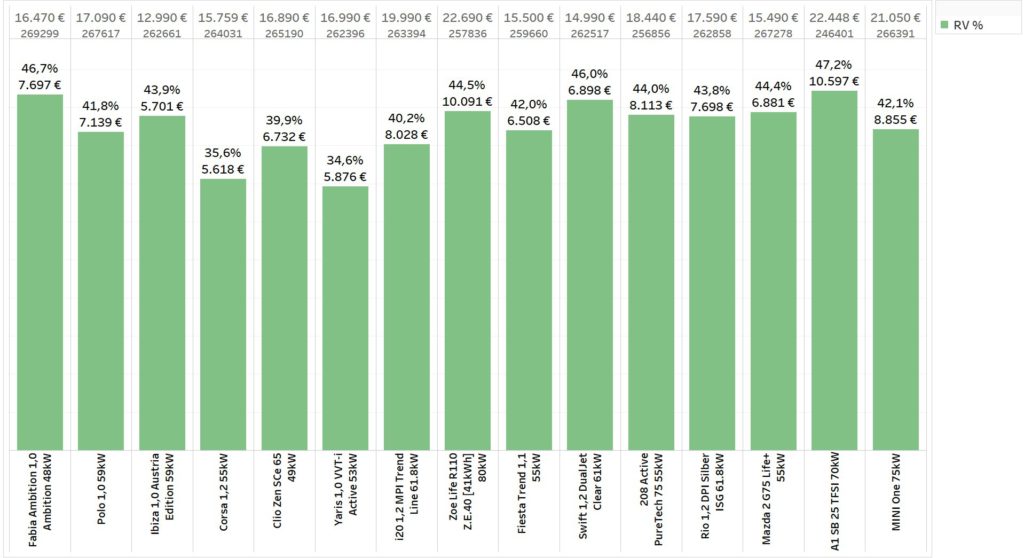

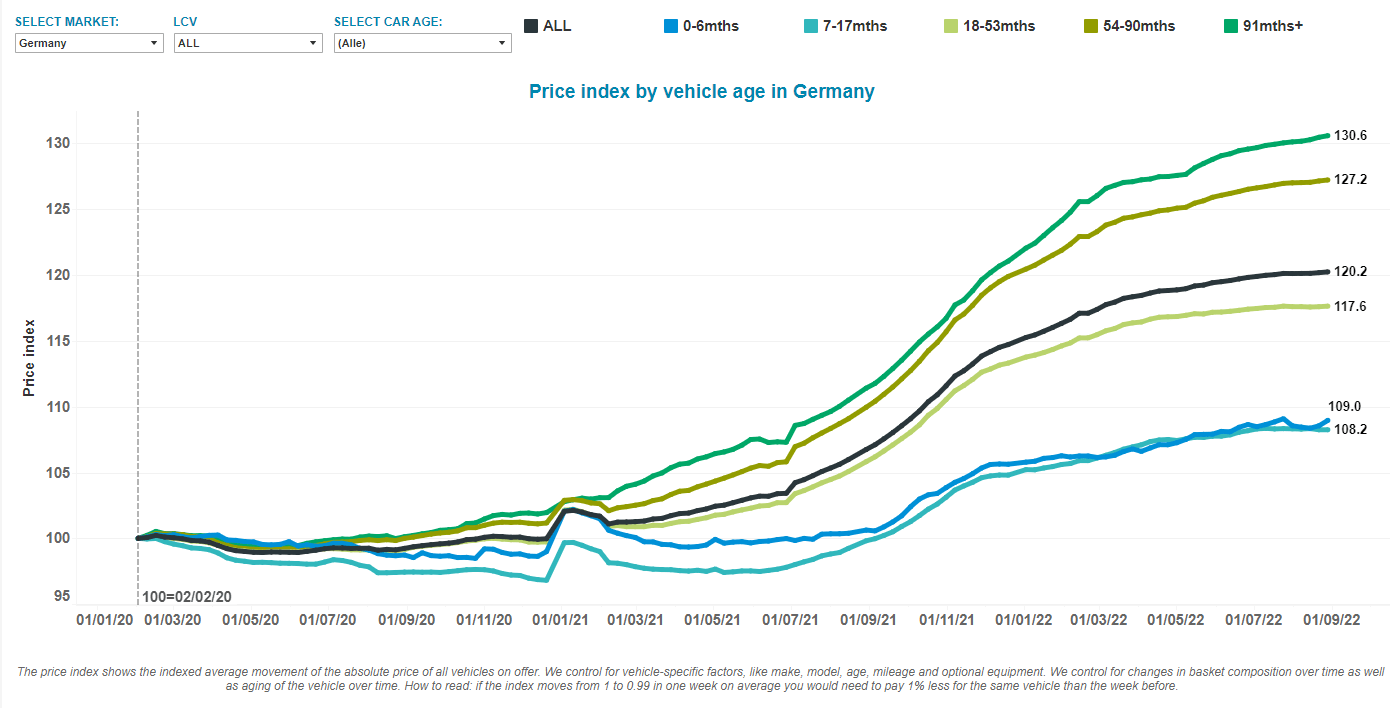

Hohe Preise dämpfen die Kompromissbereitschaft

Das Segment der über vier Jahre alten Gebrauchtwagen gerät zunehmend unter Druck. In dieser Kategorie sind die Preise stärker als in jeder anderen Altersgruppe angestiegen, was erklärt, warum sich dieses Segment jetzt verlangsamt. Laut Geilenbruegge ist es „aufgrund des verknappten Angebots in Kombination mit sehr hohen Preisen schwieriger, den richtigen Käufer für ein bestimmtes Fahrzeug zu finden. Bei diesen Preisen sind die Menschen nicht bereit, Kompromisse einzugehen, und einige verlassen den Markt.”

Gebrauchtwagen-Preisindex nach Altersgruppe (Beispiel: Deutschland)

Quelle: Autovista Group, Residual Value Intelligence

Unsichere Prognose für 2023

Die Ursprünge der aktuellen Krise liegen in unterbrochenen Lieferketten, einer starken Nachfrage sowie einer soliden privaten und öffentlichen Kaufkraft. Nach dem Konjunktureinbruch im Jahr 2020 kam es 2021 zu einem raschen Aufschwung, der die Energiepreise und die Inflation bereits gegen Ende 2021 in die Höhe trieb.

Der russische Einmarsch in der Ukraine Anfang 2022 hat die Energiepreise weiter in die Höhe getrieben. Sie machen etwa 50 % der Inflation aus, die wir in Europa erleben. Die Zentralbanken greifen spät, aber dafür umso härter durch, was die Wirtschaft zusätzlich belastet. Darüber hinaus kommt es in China nach wie vor zu Engpässen bei der Halbleiterproduktion sowie zu Lockdowns, die die Lieferketten weiterhin beeinträchtigen. Auch weitere Coronaviruswellen im Herbst und Winter könnten negative Auswirkungen haben.

Das Basisszenario der Autovista Group für 2023 geht von anhaltenden Lieferkettenproblemen, einem sehr niedrigen Wirtschaftswachstum gepaart mit hoher Unsicherheit und einer Inflation oberhalb der erwarteten Werte aus. Dadurch werden die Neu- und Gebrauchtwagenmärkte weiterhin unter Druck stehen. Der derzeitige Rückgang auf den Neuwagenmärkten wird großteils von Lieferkettenproblemen verursacht – die meisten Fahrzeuge, die zugelassen werden sollen, wurden bereits vor vielen Monaten bestellt. Einige der Lieferkettenprobleme in der Automobilindustrie sollten sich 2023 – dem vierten Krisenjahr – verbessern.

Die Neuwagenzulassungen sollten im Vergleich zu 2022 wieder ansteigen. Dies sollte auch die Gebrauchtwagenmärkte entsprechend anregen, da mehr Autos auf den Markt kommen werden. Sowohl auf dem Neuwagen- als auch auf dem Gebrauchtwagenmarkt wird für 2023 eine Erholung erwartet, was aber nicht bedeutet, dass 2023 für die Automobilindustrie ein Jahr des Aufschwungs wird.

Natürlich hängen die Prognosen für 2023 davon ab, wie schnell eine Abnahme der Vielzahl an negativen Faktoren erwartet wird. Es könnten sich im Jahr 2023 auch positivere Szenarien entwickeln – wenn in der Ukraine beispielsweise eine stabile Waffenruhe erreicht werden kann, oder wenn die Energiepreise fallen. Leider scheint es jedoch ratsam, die Prognosen auf eine negativere Wendung der Dinge auszurichten. So stellte der IWF in seiner Wirtschaftsprognose vom Juli fest: “ … die Risiken für die Prognose deuten eindeutig in eine ungünstige Richtung.”

Dieser Inhalt wird Ihnen präsentiert von Autovista24.

Wir möchten Sie darauf hinweisen, dass es sich bei diesem Artikel um eine Übersetzung handelt. Das Original wurde in englischer Sprache auf Autovista24 veröffentlicht. Sollte dieser Artikel kleinere grammatikalische Fehler enthalten, bitten wir, dies zu entschuldigen. Im Falle einer Diskrepanz zwischen den beiden Texten ist die englische Version maßgeblich.

Schließen

Schließen